Bitcoin Is Getting Closer to Central Bank's Coffers as Czechs Float the Idea

The Czech Republic continues to surprise the cryptoasset market with ideas that could promote broader bitcoin (BTC) adoption. This time, waves were made by the head of the country's central bank, as this conservative institution doesn't rule out investing in the most popular cryptocurrency.

Per local media reports, Aleš Michl, the head of the Czech National Bank (CNB), admitted that he was considering whether the bank should invest in BTC. Michl reportedly mulled buying "a few bitcoins" but emphasized that he did not mean to invest massively. However, the governor noted that this investment could still be discussed further by the bank's board. No additional details were provided. Meanwhile, the bank continues increasing its gold reserves and aims to double them to 100 tons by 2028.

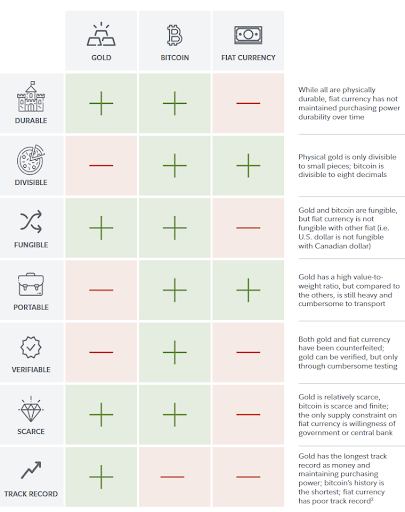

Among other things, BTC is often considered "digital gold." According to the US-based investment giant Fidelity, BTC outranks gold in divisibility, portability, and verifiability, while gold only has a longer track record.

Meanwhile, despite exploring BTC, the CNB governor demonstrated a certain level of ignorance when it comes to his understanding of the technology. In an interview with a local TV channel, Michl said that none of the central bank staff had seen Bitcoin's source code. The code is open-source and can be reviewed by anyone.

The Czech Republic is also known for its recent decision to exempt cryptoassets from taxes if held for more than three years, while also creating a more friendly environment for spending cryptocurrencies without taxing them.

So far, no central bank in the world is known to hold BTC. However, in Switzerland, a campaign was recently launched to collect 100,000 signatures within 18 months to trigger a referendum on obliging the country's central bank to hold BTC. Meanwhile, other central banks are also studying Bitcoin. For example, the Minneapolis Fed has claimed that BTC might pose an obstacle for governments attempting to run consistent budget deficits.

In 2022, a paper by Matthew Ferranti, then a PhD candidate in Harvard's economics department, argued that it makes sense for central banks to invest at least a small amount in BTC under normal conditions, with higher investments justified if the country is facing sanctions.