Pump & Dump Cryptos Keep Pumping by Using This Eight-Step Scheme

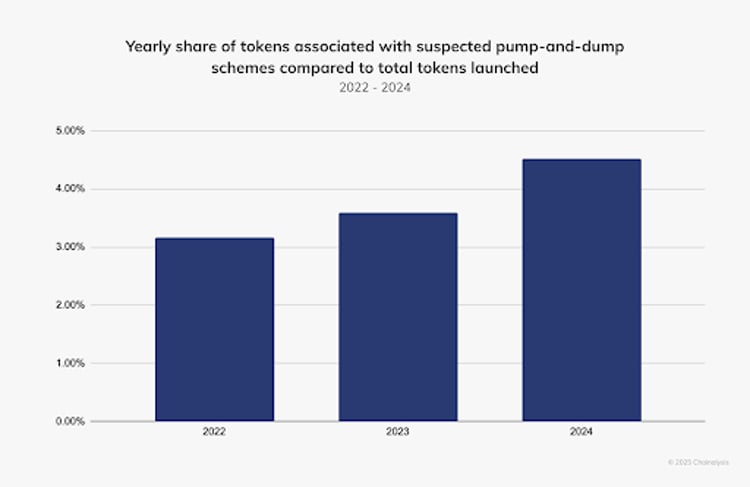

The latest data from blockchain analysts shows that the share of cryptoassets associated with suspected pump-and-dump schemes has been growing for at least two years in a row, reaching 4.52% in 2024.

However, this number, provided by the blockchain analysis company Chainalysis, only accounts for three blockchains—Ethereum, Base, and BNB. The report didn't include Solana, which is known for tens of millions of memecoins launched last year, substantially increasing the number of crypto scams in the market. Additionally, according to analysts, they made several changes to their methodology this year to improve accuracy, which could have also influenced the final result.

In either case, Chainalysis calculates that out of more than 3 million tokens launched on the aforementioned chains last year, 137,158 are suspected to be pump-and-dump coins, meaning that perpetrators artificially inflate the price of these tokens before dumping them on naive investors.

In 2022, the share of these tokens was closer to 3%.

Blockchain analysts also provided an eight-step breakdown of how a crypto pump-and-dump scheme works:

- A new token is launched, or someone buys an existing token, usually one with historically low volume.

- The token is then hyped on social media and/or online chat rooms.

- Once attention is secured, money starts flowing into the token, increasing buying pressure.

- The initiator of the scheme may also engage in "wash trading"—artificially inflating trading volume—to further boost the token’s activity.

- If all this works, the price of the token jumps.

- Once the price reaches its target, the perpetrator sells their entire position for profit.

- As the price of the token subsequently crashes, many victims are left "holding the bag."

- Moreover, the perpetrator might completely abandon the project in a rug pull, taking more users’ funds with them.

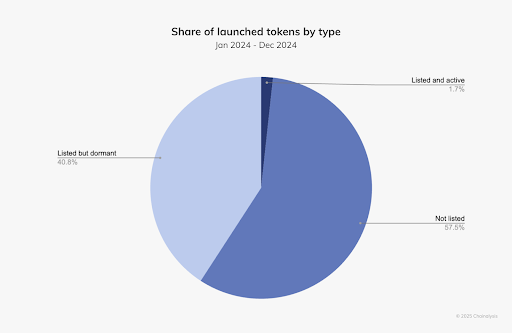

Meanwhile, Chainalysis also noted that only 1.7% of all tokens launched have been actively traded within the last month. Analysts suggest this could be due to two reasons: either these tokens appear dormant because they failed to gain traction, or "some of these tokens facilitate intentional short-lived schemes designed to exploit initial hype before fading away—also known as pump-and-dumps or rug pulls."

According to the research, it usually takes a few days to a few months before the associated token is abandoned, with the average lifespan being 6.5 days. Almost 43% of all launched tokens were listed on decentralized exchanges, or platforms that at least claim they don't have a centralized operator.