Putin and Fed Boss Recognize Bitcoin's Power as BTC Smashes Through $100,000

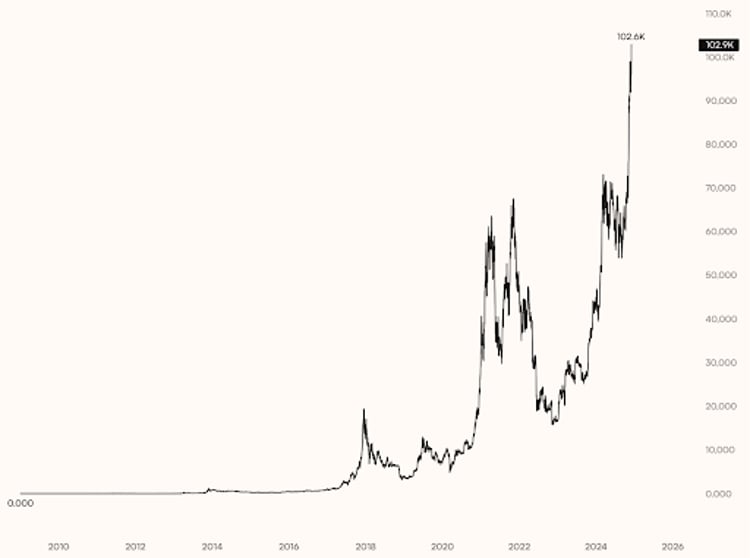

Less than a day after aggressor state Russia's president Vladimir Putin and US Federal Reserve (Fed) chairman Jerome Powell acknowledged the staying power of Bitcoin (BTC), the price of the top cryptocurrency smashed through $100,000 for the first time in the nearly 16-year history of this decentralized project.

On Thursday morning (UTC), the price of BTC reached its all-time high of around $103,700, more than doubling in a year.

The new price record followed US President-elect Donald Trump's nomination of Paul Atkins as the next Chairman of the Securities and Exchange Commission (SEC). Atkins, a former SEC commissioner from 2002–2008 and now Founder and CEO of the financial consultancy firm Patomak Global Partners, is considered friendly toward the cryptoasset industry.

In an interview a year ago, he criticized the current SEC's stance towards this industry.

Meanwhile, two videos featuring powerful men began circulating on social media, further cementing Bitcoin’s growing prominence.

First, speaking at an international investment conference organized by Russia's second-largest lender, VTB, in Moscow yesterday, Putin, responsible for the war in Ukraine, emphasized that nobody can ban Bitcoin or prohibit the use of other electronic means of payment.

"Because these are new technologies. And no matter what happens to the dollar, these tools will develop one way or another, because everyone will strive to reduce costs and increase reliability," Putin said.

Shortly after, another video surfaced from the New York Times DealBook conference, where the Fed chairman discussed Bitcoin, describing it as a competitor to gold.

"People use Bitcoin as a speculative asset. It's like gold, only it's virtual, digital. People are not using it as a form of payment or as a store of value. It's highly volatile. It's not a competitor for the dollar; it's really a competitor for gold," Powell said.

At the time of writing, the market capitalization of BTC exceeds $2 trillion, compared to the estimated market capitalization of $17.9 trillion for gold. In either case, for now, BTC has outperformed gold across multiple timeframes.