Top 5 Events That Could Crash Bitcoin Price in 2025

Bitcoin (BTC), the oldest, largest, and most popular cryptocurrency network, is also considered to be the most secure and decentralized. However, it doesn’t operate in a vacuum, and the world is always full of surprises and black swan events that might hurt this blockchain network and its asset, BTC.

Changes in the macroeconomic environment, geopolitical issues, regulations, unknown AI-related developments, and more—these factors could all affect bitcoin prices.

While, in theory, predicting a so-called black swan event is very hard since such events are outside normal expectations, we can examine the top five “grey swan” events—those that can be anticipated based on current developments—and consider how they might impact Bitcoin as a network and blockchain, and/or BTC as a cryptocurrency.

Trump’s Promises Fall Short, BTC Reserve Ditched

Much of the rally in BTC prices in November and December is attributed to Donald Trump’s victory in the U.S. presidential elections. This surge is driven by hopes and mounting signs that the Trump administration will adopt a friendlier stance toward the cryptoasset industry than the current Biden administration, which is known for its hostility toward the sector.

One key BTC-related proposal from the Republican camp is the establishment of a Strategic Bitcoin Reserve (SBR) in the U.S. The bill has already been drafted and is being pushed forward, with Trump and his allies signaling that this reserve could materialize. While industry observers remain skeptical and it’s unclear whether the U.S. government would purchase BTC for the reserve or only hold seized assets, the proposal has already triggered an international race among other countries to establish their own reserves.

If Trump fails to deliver on his campaign promises or the SBR initiative is abandoned or indefinitely delayed, BTC prices could suffer a significant drop. However, the worst likely scenario is that the SBR might stagnate during Trump’s presidency without concrete decisions being made. It’s worth noting that the U.S. government is already one of the largest BTC holders globally. That said, both positive and negative outcomes remain possible.

Unexpected Quantum Computing Breakthrough

Following Google’s recent, somewhat overhyped quantum computing breakthrough with its Willow quantum chip, the Bitcoin and broader blockchain community have ramped up discussions about quantum resistance. While Bitcoin security experts generally agree that a quantum threat is unlikely to materialize soon, the fact remains that neither Bitcoin nor the wider blockchain ecosystem currently has a comprehensive solution to withstand a potential quantum attack.

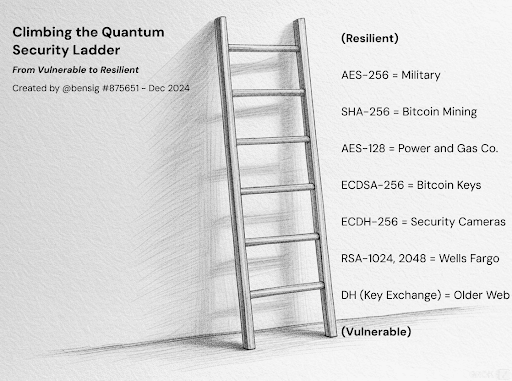

As Jameson Lopp, Bitcoin security expert and co-founder of BTC custody solutions provider Casa, recently stated, "We can see the trends, but can't precisely predict the point at which we're all screwed." While highly unlikely, if such a breakthrough were to occur in 2025, it could severely impact BTC prices. Even smaller announcements about advances in quantum computing could unsettle the market, as many BTC users lack a deep understanding of Bitcoin’s current security measures. According to Bitcoin author Ben Sigman, quantum computing must overcome several encryption standards before posing a real threat to Bitcoin:

MicroStrategy Runs Into Trouble

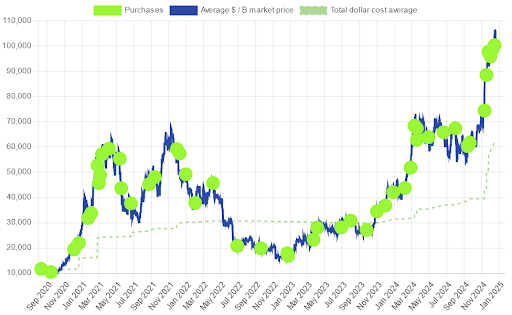

This year, U.S.-based business intelligence firm-turned-Bitcoin company MicroStrategy has been a hot topic of debate, even among traditional finance experts, due to its aggressive BTC acquisition strategy. The company continues to purchase BTC, borrowing billions of dollars at 0% interest rates to fund these investments. At the time of writing, MicroStrategy holds 439,000 BTC (worth $43 billion), equivalent to 2% of the total BTC supply.

Concerns are mounting that the stakes are becoming increasingly precarious, with such a significant single point of failure. The primary risk is that MicroStrategy could face trouble if BTC prices plummet, its shares (up 526% over the past year) tumble, or it loses access to low-cost borrowing. However, research indicates that BTC prices would need to drop by at least 80% before MicroStrategy starts experiencing financial strain.

Other potential risks include the hacking of custodians securing the company’s BTC—a risk also relevant to BTC exchange-traded funds (ETFs) that hold tens of billions in BTC. Additionally, any change in leadership or strategy by founder Michael Saylor—such as endorsing other cryptoassets or, in a worst-case scenario, an unexpected illness or death—could introduce uncertainty. Earlier this year, Saylor mentioned that his personal BTC holdings would vanish upon his death, akin to the untouched multibillion-dollar portfolio of Bitcoin’s anonymous creator, Satoshi Nakamoto. However, Saylor has also floated the idea of donating his BTC, demonstrating that the future of these holdings remains uncertain.

A related concern is Saylor’s strained relationship with segments of the Bitcoin community advocating for protocol changes to enhance Bitcoin’s use cases and privacy features. This brings us to the fourth risk.

Big BTC Players Start Shaping Bitcoin’s Future to Their Needs

Bitcoin has long been a battleground for intense debates about how the protocol and network should evolve. The concern now is that as major players like MicroStrategy, ETF operators (including BlackRock, the world’s largest asset manager), and possibly governments amass substantial BTC portfolios, they could use their influence to steer Bitcoin’s direction in ways that align with their interests.

While history shows that smaller players can prevail against large entities—evidenced by the defeat of Bitcoin mining giants during the 2017 Block Size War—the involvement of financially powerful players raises questions. Upcoming battles over protocol changes, such as the introduction of covenants to enhance Bitcoin’s functionality, security, and privacy, are expected to intensify in 2025. These developments could reveal the true positions of large BTC holders and their willingness to leverage their influence.

Concerns could also arise about whether these players might eventually target Bitcoin’s 21-million supply cap, a cornerstone of Bitcoin’s value proposition. While such changes are complex and difficult to achieve, even the perception of centralized influence could unsettle the market.

Technological, Competitive, and Adoption Risks

The fifth risk ties into the fourth, focusing on Bitcoin’s evolution and the potential dangers it entails. For example, implementing protocol changes to enhance functionality and privacy could appeal to proponents of Bitcoin as a versatile technological platform. However, large holders such as MicroStrategy, ETF operators, and governments might view such changes as threats to Bitcoin’s store-of-value narrative. Additionally, heightened privacy features may not align with their interests as well, making this technology less appealing.

Protocol changes also carry the risk of bugs, as evidenced by past disclosures of vulnerabilities by Bitcoin developers. Broader concerns include Bitcoin’s ability to compete with other networks, shifts in its top narratives, and its scalability to serve billions of users. These discussions could introduce uncertainty, which markets inherently dislike.

Expect to see more of those in 2025.

____________________

While no outcome is guaranteed, understanding these risks and preparing for unexpected developments can help mitigate potential impacts. In either case, the year 2025 will put Bitcoin and the market to the test yet again. Be ready.