US Launches Global Bitcoin Reserve Race: What It Means and Why BTC Dropped

Tonight (UTC time), the news that US President Donald Trump signed an executive order establishing the Strategic Bitcoin Reserve (SBR) and a crypto stockpile was met with mixed reactions, as the price of BTC dropped while industry players claimed the order opens up a global race for BTC.

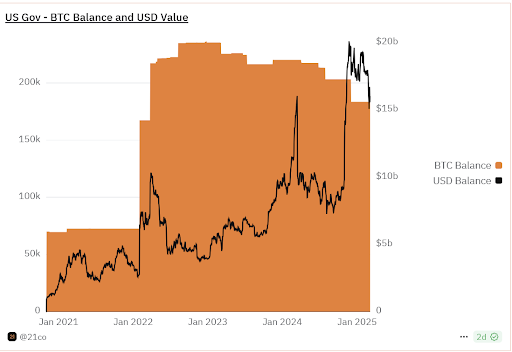

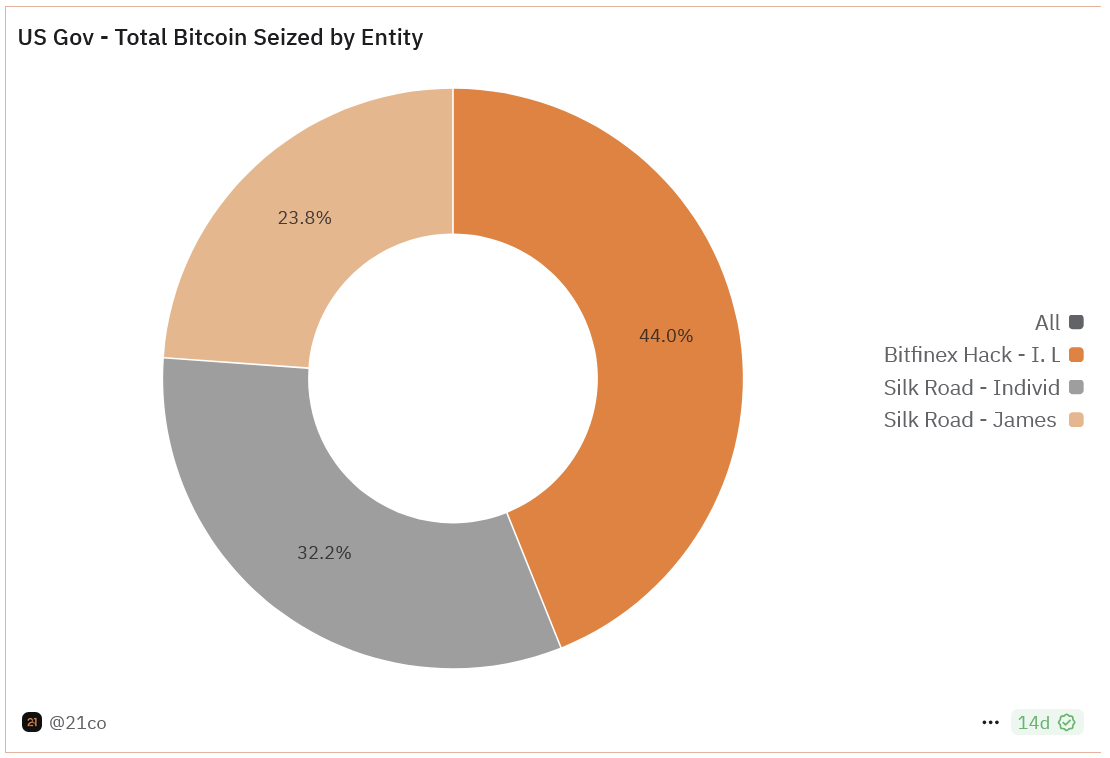

While the news was expected, the content of the order wasn't known until now. BTC dropped around 5%, briefly spiking below $85,000 before trimming losses, as the market learned that the US government doesn't intend to start buying BTC in the near term, as the SBR is going to be financed with already seized BTC. It is estimated that the government now holds 183,422 BTC ($16.2 billion), of which 94,643 BTC were seized from the hackers of the Bitfinex exchange and are expected to be returned to the company.

"Because there is a fixed supply of BTC, there is a strategic advantage to being among the first nations to create a strategic bitcoin reserve," the order reads.

However, it also establishes that BTC deposited into the Strategic Bitcoin Reserve shall not be sold, while the Secretary of the Treasury and the Secretary of Commerce have been instructed to develop strategies on how to buy more BTC without imposing "incremental costs on United States taxpayers."

Meanwhile, when it comes to the US Digital Asset Stockpile, it is separate from the SBR and would be financed only with seized assets unless applicable laws are changed.

In either case, while the initial market reaction more resembled a "sell the news" event, industry players emphasized that the executive order is bullish for bitcoin long-term.

Summarized, here are the main points industry players are making:

- Reduced likelihood of the US selling its BTC stash;

- Reduced likelihood of the US banning bitcoin;

- Increased likelihood of separate states within the US buying BTC;

-

Increased likelihood and speed at which other countries will create their BTC reserves;

- Institutions, such as the International Monetary Fund, will find it harder to negatively position bitcoin;

- Wealth managers, financial institutions, pensions/endowments have no excuse not to invest in BTC;

- BTC is separated from other cryptoassets while also emphasizing its uniqueness due to its fixed supply.

Meanwhile, Nic Carter of Castle Island Ventures, who was opposing the idea of an SBR, has a "bonus" point: "If Satoshi [Nakamoto, the creator of Bitcoin] really is the [US National Security Agency] (as I suspect) and they have ~1m BTC sitting on a dusty hard drive in Ft Meade, this [executive order] just ensured that they don't ever sell those."

As not every bitcoiner is happy with the SBR, it also opens up a serious question when it comes to the development of Bitcoin technology. Matthew Pines, executive director of the Bitcoin Policy Institute, reminds us of a "fair concern about what an SBR means for the long-run dynamic around Bitcoin development and ossification" because the US government might oppose possible changes to the protocol that could bring more use cases or increase the privacy of BTC users.

Before the SBR order was signed, Andrew M. Bailey, a Professor of Humanities at Yale-NUS College (Singapore), stressed that one of the arguments for establishing an SBR is not because of possible price appreciation but because of the utility of BTC.

"This also supplies us with a plausible answer to the question: why bitcoin? Why not TSLA? Or NVDA? Because bitcoin can do things these other assets cannot. Its value lies, not merely in the expectation of future appreciation, but in utility," Bailey said.

At the time of writing, BTC had trimmed most of its post-executive order losses and was hovering near $88,000, up 10% in a week and down 10% in a month.