War Against Scam Memecoins is Brewing After Another Presidential Pump & Dump Wipes Billions

As billions in USD have been created from thin air and then wiped out from the market in the third presidential crypto pump & dump scheme this year, the discontent even within the crypto community itself is transforming into calls to fight scam memecoins that enrich a few and bring losses to thousands of people.

First, Donald Trump, a few days before his inauguration in January, launched his memecoin, TRUMP, which was deemed to be one of the most successful memecoin launches in history, making Trump billions on paper. However, since then, the token has crashed almost 80%. Meanwhile, the token of Trump’s wife, now the first lady of the US, Melania, was launched just a couple of days after her husband’s token, and after the initial pump in price, MELANIA is down 90%.

Meanwhile, this past weekend, another president of one of the countries in the G-20 club, or the 20 largest economies in the world, Javier Milei, the leader of Argentina, found himself in a troubling situation after a token he endorsed on the X platform, LIBRA, skyrocketed 2000% but tumbled 90% in a matter of hours after Milei revoked his endorsement by deleting the original post. While insiders of the project managed to pocket some $100 million from this pump & dump event (however, they claim they only have custody of the money), Milei has ordered an investigation into this matter while facing fraud charges and possible impeachment himself.

While everyone is trying to figure out who’s who in this story and who is to blame, an increasing crowd of crypto industry players is now calling to end this scam memecoin craze.

“The memecoin launch game is a dirty game with plenty of ugly behavior,” developers of the decentralized crypto exchange Jupiter said, while trying to defend themselves for listing LIBRA and against accusations of insider trading.

According to them, LIBRA was brutal for everyone: “In fact, many memecoins have been brutal for the ecosystem for a long time now with sniping, bundling, and all becoming the norm.”

In a live interview today with Coffeezilla, an internet detective focusing on scams, Hayden Davis of Kalsier Ventures, who claims to be the launch advisor for the LIBRA project, with the involvement of KIP Network, admitted that they were sniping this project themselves, supposedly to protect it from other snipers.

In memecoins, sniping refers to a technique where bots try to find early lucrative projects, buy them early, and then automatically sell the token once predefined criteria are reached, e.g., desired profit.

“His defense was basically, 'Every memecoin is theft, so how was I supposed to launch one without stealing?'” a YouTube commenter reacted to the statements of Davis.

Stop normalizing scams

Meanwhile, Alex Krüger, an Argentine economist and crypto trader, stressed that “We need to stop normalizing pump and dumps in crypto” and that he “had not felt this level of disgust with crypto” since the collapse of the FTX crypto exchange in 2022.

“Exchanges should stop listing and prioritizing memecoins. It’s hypocritical to tell people to ‘build’ while primarily just listing memecoins. The projects that try to build anything are often ignored or face huge listing fees, while the memecoins are often listed for free,” another crypto trader, Benjamin Cowen, added.

Other prominent crypto market players, such as Ignas | DeFi, even threatened to “unfollow and mute everyone [on X] who shills low and mid-cap memecoins.”

“No need for this scam to continue,” he said, receiving support for this idea from his followers.

However, Nic Carter, a bitcoin and crypto venture capitalist, provoked by saying that, in the LIBRA case, crypto people are upset only because someone else executed this scheme and not them.

“The coin wasn't any more or less meritless and odious than any other memecoin launch. If this is the catalyst for finally abandoning memecoins, it's for the best and we should all write him a thank you letter,” Carter said.

In the meantime, while some commenters stressed that it is the free market that should decide the fate of memecoins, others emphasized that this problem runs deeper in society and that strict regulations, fines, or technical solutions wouldn’t be effective.

“People want fraud. They want to be part of the fraud, ponzis, OneCoins as such, and hope they can exit before anybody else,” Mikko Ohtamaa, co-founder of Trading Strategy, an algorithmic trading protocol, said.

According to him, the long-term fix is for enough people to burn their fingers and stop playing the game.

“Personally, I feel it's morally okay to see people losing money in the Libra fiasco as part of the problem. They should not complain, as I am sure everyone participating in these games knows how crooked they are, how crappy the odds,” Ohtamaa said.

Bitcoiner Dan McArdle also shared his take:

CZ’s Broccoli and ties with MELANIA

Last week, even Changpeng Zhao (CZ), the co-founder of the largest crypto exchange, Binance, who served four months in a US prison last year, helped some memecoin pump & dump schemes after he posted a story about his dog, named Broccoli, suggesting that others might create Broccoli-inspired memecoins.

Meanwhile, during the LIBRA scandal, blockchain analysts found that the people behind this project were also behind the MELANIA memecoin. Moreover, Hayden Davis himself admitted that he was part of MELANIA's launch and also sniped it, while also claiming that he was told that some people were given early access to the TRUMP token, a claim that is now difficult to confirm.

What happens with the LIBRA project, which claims to be designed to help Argentinian companies raise capital, is anyone's guess.

Davis said he, “as the custodian—not the owner—of these funds,” intends to reinvest “as much as $100 million back into the Libra Token and burn all bought supply,” meaning the tokens would be destroyed, limiting its supply, unless “a more viable alternative is presented.”

However, not everyone was convinced by Davis. Pix, a Web3 researcher, reacted by saying that Davis, with his statement, has just confessed to insider trading, market manipulation, misappropriation of funds, failure to disclose material information, and other crimes.

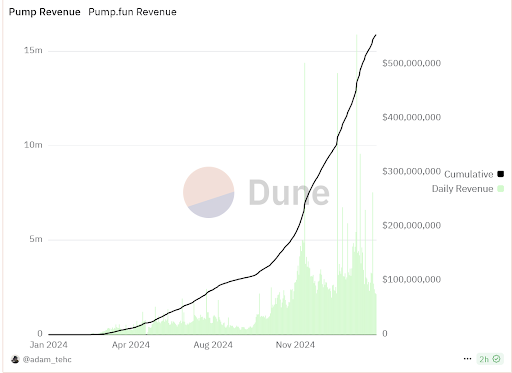

Meanwhile, as voices against the current memecoin craze grow stronger, Pump.fun, the most popular memecoin launch platform, just introduced its mobile version, making launching tokens even easier.

It is estimated that the platform has helped to launch more than 7.8 million memecoins. At the time of writing, in the past 24 hours, more than 38,000 memecoins have already been launched.

"Memecoins are not for investing. They are for fun. Hope you are having fun," Ohtamaa concluded.