What's in Store for Bitcoin Price in the Near Term as it Keeps Grinding Lower

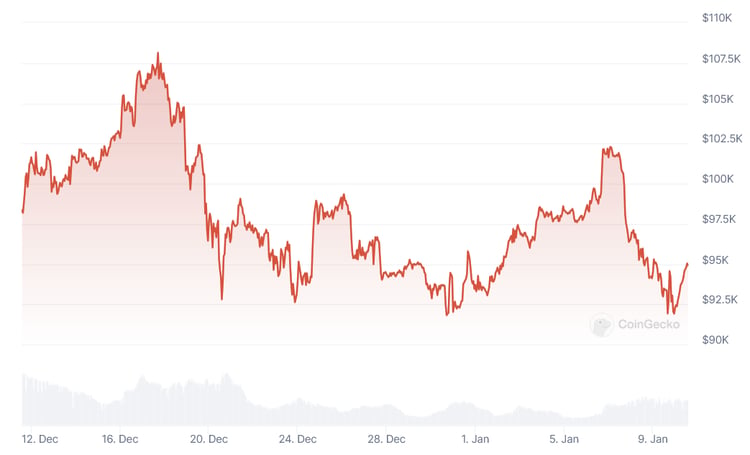

After a week-long strong rally in the first week of 2025, the price of bitcoin (BTC) turned down and seems to still be looking for a new bottom. However, while the short-term outlook for the most popular cryptocurrency is unclear, industry observers are still optimistic about this year.

From its 2025 high of more than $102,000, reached on January 7, BTC dropped to almost $91,000 yesterday but is trying to climb back to the $95,000 level today. If it succeeds, it would still be around 7% lower than the high this week. The price is still up 108% in a year.

The market, including stocks and other riskier assets such as BTC, dropped this week after inflation concerns strengthened due to strong U.S. economic data. It might force the U.S. Federal Reserve (Fed) to become even more hawkish when it comes to cutting interest rates, which makes risky assets less attractive. Moreover, a rally in U.S. Treasuries makes this asset class more attractive, luring capital to pick Treasuries instead of BTC.

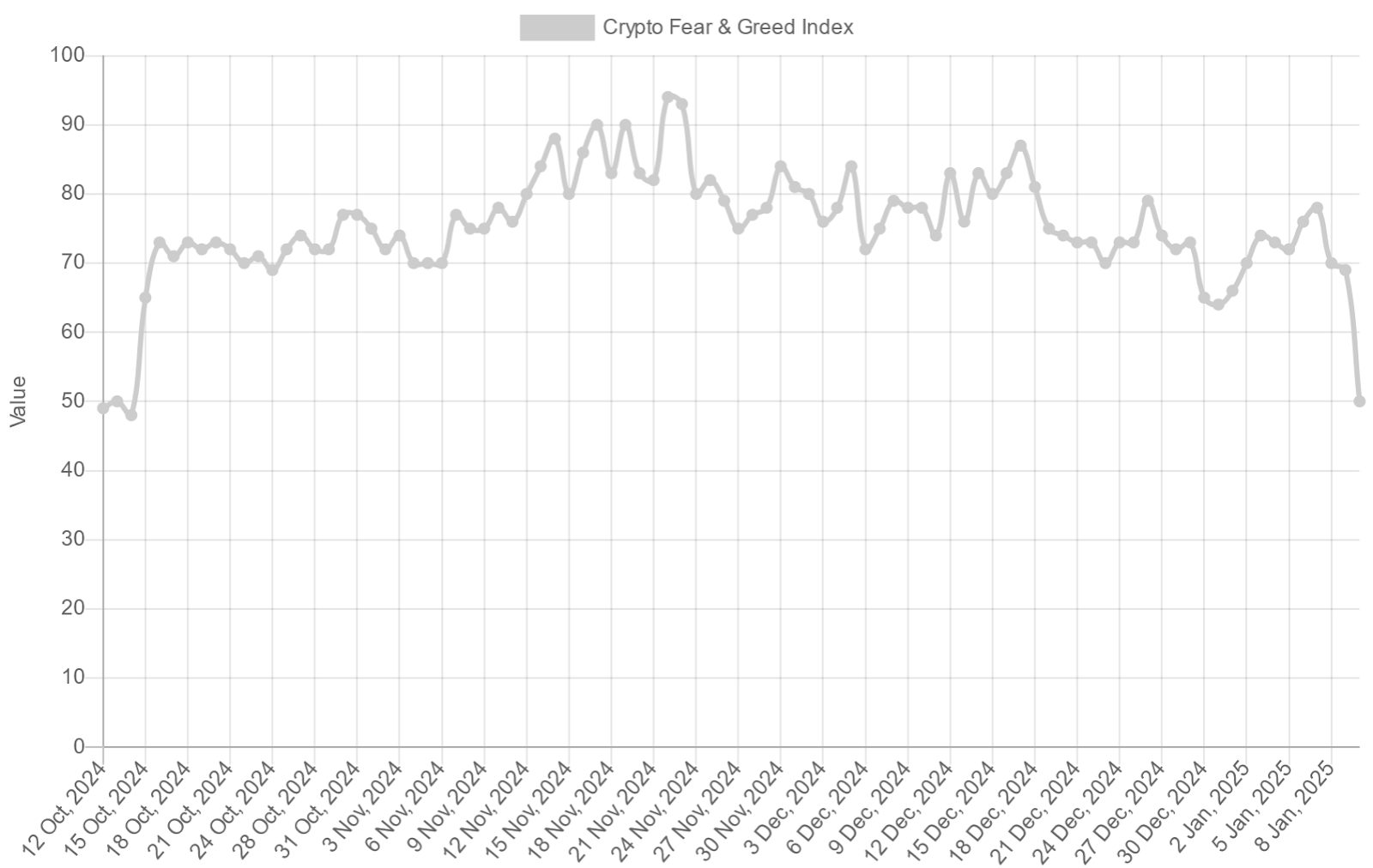

Analysts are now looking at the $90,000 level and are forecasting that if this level doesn't hold up, the price might dive toward $80,000 or even lower. The sentiment in the market has also somewhat worsened as the Fear & Greed Index, which is used to track this sentiment, moved from the Greed zone to Neutral in a day, reaching a level last seen in October last year.

However, trading veteran Peter Brandt notes that looking at the charts, it might appear that BTC is once again building a so-called "bear trap," when the market appears to be reversing into a downtrend but unexpectedly rebounds. In either case, it should be taken into consideration that the environment this time is different, and this bear trap, for now, might not materialize.

The options trading market is also signaling that the majority of traders are still hoping for a rebound above the $100,000 level later his month. That said, trader and economist Alex Krüger also opined that "people are way too bearish now."

"Yes, most crypto natives are tired and many even traumatized. Under normal conditions, that can actually create a top. But this time [traditional finance] is here buying bitcoin (it is not [Michael Saylor, the founder of MicroStrategy] alone). They could not care less about crypto natives' traumas," Krüger stressed, suggesting that the equities top might also not be in, as BTC is now correlated to this market more strongly, and the Fed hasn't finished cutting rates, while pro-BTC Donald Trump is also about to be inaugurated on January 20.

However, the trader warned that he doesn't expect "easy mode" going forward, but he still expects BTC to hit its new all-time high in the unspecified future.

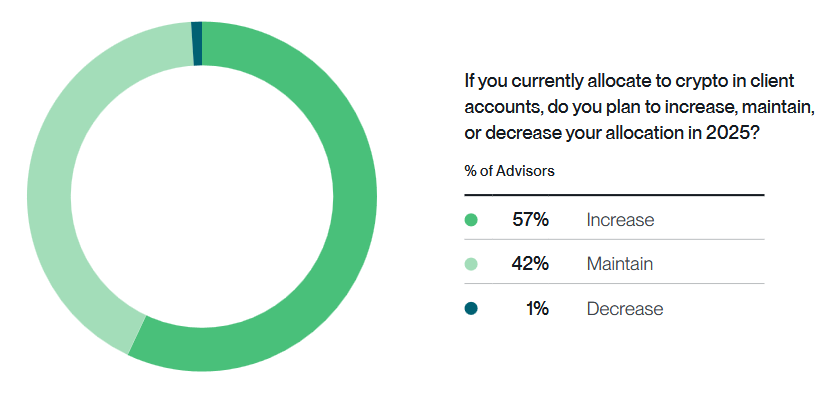

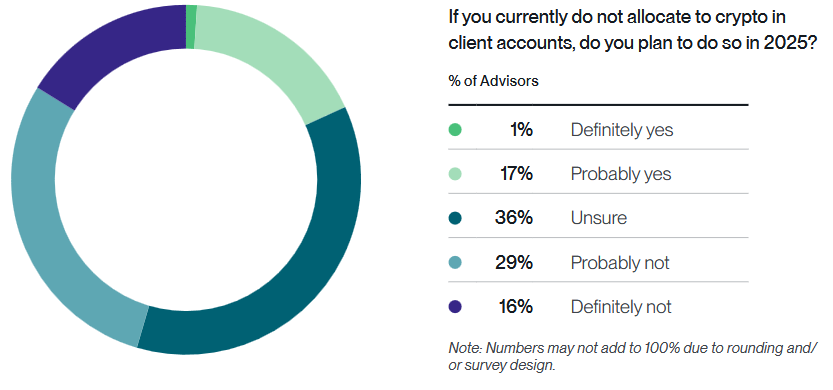

Meanwhile, a survey of financial advisers in the U.S. has indicated that they are mostly planning to increase allocations to cryptoassets this year.